Opening a Domiciliary account in Nigeria could be a bit stressful as the documents needed and requirements are difficult to get;there is just one reason for this and nothing more: “The banks want to make profit from where they did not sow”. The main reason being that they want you to use other means of receiving foreign funds that will only allow you convert the equivalent of the foreign currency you want to withdraw into Naira, so that they will use the exchange rates that will favor them and not you. Because of this, they make theprocess of opening a domiciliary account stressfultogether with the reluctance of enlightening customers on the uses of a Domiciliary account and what it is all about. I will explain the steps below.

Table of Contents

How to open the domiciliary account in Nigeria

In order to open aDomiciliary account in Nigeria, you need to have some means of identification and also fulfill some requirements/Criteria. These criteria are dependent on whether you have a bank account with the them or not.

Opening aDomiciliary account when you have not gotten an account with the bank (Your first account with the bank)

When you need to open a domiciliary account but you do not have an account with the bank. The banks will first of all ask you to open either a current account or savings account first.

After you have done that, they will then ask you to fill the form for opening of the domiciliary account.

Gtbank requirements for opening an individualdomiciliary account:

- Two Referees:In order to proceed with yourdomiciliary account opening with Gtbank, you need to provide two people who are CURRENT account holders that could stand for you to guarantee that you are of good conduct and that you will be able to maintain a current account with the bank. In order to get these people, GTBank provides you with two forms to give to the referees to fill.

After they fill out the form, you need to submit it to the Bank where you got them from.

The contents of the Referee form include:

– Name of Individual opening the account: this will be the name of the person that wants to open the account of which you want to stand as the referee. The name should match the name that the individual had given the bank already.

– Comment about the individual: this is where the referee will make a comment such as: is the individual reliable, trustworthy, of good character etc?

– The name of the bank that the referee has adomiciliary account with them: The referee must state the name of the bank that he/she has an activedomiciliary account with. Please note that even if you opened the account with Gtbank, you still need to write “GTbank” as the bank. This is because the referee is not restricted to be a GTBank customer but could be from any bank. So if you get a Referee with a Firstbankdomiciliary account, the name of the bank will be “Firstbank” even if the person you want to referee is opening the account with a different bank.

– The domiciliary account number of the referee will be filled too.

– The signature that the referee uses to open thedomiciliary account will be required.

– The address of the referee will be required.

– The duration of which the referee knows the individual will be stated. This is the number of years that the referee has known the person that wants to open the account.

– The phone number of the refereePlease note that when you finally submit the account details of the referee, the bank may decide to call the person to confirm the authenticity of the information you provided.The referees you will provide must fulfill the following criteria:

– Their accounts must not be less than 6 months. If they opened the current account within the last 6 months, then they will not be suitable for you. Get referees whose current accounts are more than 6 months.

– Their accounts must not be dormant. Their accounts should be active, which means that they should have been using the account.

– Their accounts must be current accounts and the current accounts must not be used for receiving salary. - Other requirements for opening either a savings account or a current account:To proceed with opening your domiciliary account if you have never had an account with the bank, then you will be made to open either a savings account or a current account, depending on your choice. And in order to open these types of accounts, you need to provide them with all the necessary means of identification and passports and minimum deposits. You can checkthe requirements to open a savings account or current account.

- You will then fill the form for the opening of the savings or current account and also fill the form for opening thedomiciliary account.

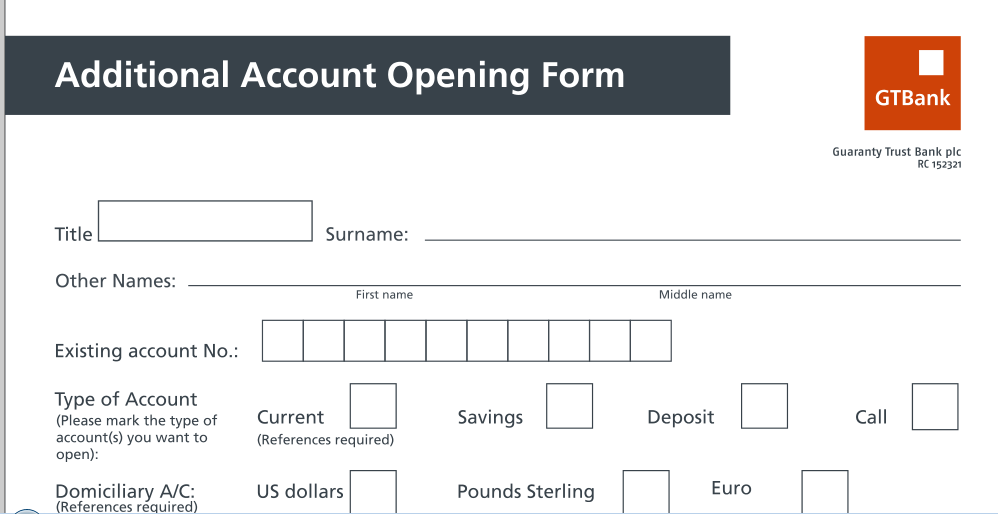

In the form for opening thedomiciliary account (Additinal account opening form), you wouldbe asked:

– the name of the Account

– you will select the type of account, since adomiciliary account is a type of current account, you will select “Current”

– the type of foreign currency you want to open the domiciliary account with; either Euro, Pounds, or Dollars.

– your address, phone number, email address and signature will be required.

– you may choose to receive SMS Alerts: you can tick “Yes” or “No”

-you may also choose to have a cheque book: you can tick “Yes” or “No” - You need to bring your means of identification: this should be any government issued ID card such as Drivers licensed, International passport, Permanent Voters card, Permanent National ID card etc.

In order for the bank to process yourdomiciliary account opening in time, you need to get the referees from the same bank as you. I was told that it will take 48 hours for GTBank to open domiciliary account for an individual if the referees are all banking with GTBank. If they are from different banks, it may take several days depending on when the referees banks respond and give out the needed details about their customers. Most times, people opening a domiciliary account often do it at the time they really need it and having to wait for other banks to respond may delay or even defeat the aim for which you want to open the account. Because of this, the referees should be from the same bank as that of the person that wants to open the account so that it can be processed within 48 hours (2 days).

The difficult thing is getting the two referees from the same bank. You may realize that most of the people you know that have an account with the bank you want to open adomiciliary account with are all having savings account. Even if you are lucky to have someone with a current account, such a person may be using it as salary account of which the banks always reject it.

Opening aDomiciliary account when you have an account with the bank (Current or Savings account)

When you already have either a savings or current account with the bank, you do not need to fill out the form for opening a new account again; all you need to do is to fill out the “additional account opening form” given by GTBank and then provide the two current account referees and yourdomiciliary account would be opened within 48 hours if your referees are from the same bank as the one you are opening the account with; if the referees are from different banks, it may take several days or weeks depending on when their banks respond. If you already have an account with the bank, your passport or utility bill will not be required but you will be required to bring your means of identity such as Drivers license, Permanent voters card, Permanent National ID card or International Passport. Please note that your temporary National ID card would not be accepted.

If you have a current account already, then you just need to fill out the form for opening adomiciliary account and that is all. In fact, if you are using internet banking and you also have a current account with GTBank, then you can use their portal to open adomiciliary account online without even going to the bank. This is because, before you opened the current account, you had provided two referees and there is no need to provide others again. This is applicable for current account holders only.

If you provide all of the above mentioned requirements, then yourdomiciliary account would be opened and the account number sent to your phone within two working days. You can then start to use it immediately.

Other banks such as FirstBank require that you make an initial deposit into thedomiciliary account before it becomes activated. This initial deposit could be withdrawn anytime after the account is activated; since it is a domiciliary account, such deposit must be made with the foreign currency you chose while filling the form. To me, this is stressful and it is the reason why I chose GTBank because they do not require any initial deposit.